UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

_______________

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| |

| |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

AquaBounty Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

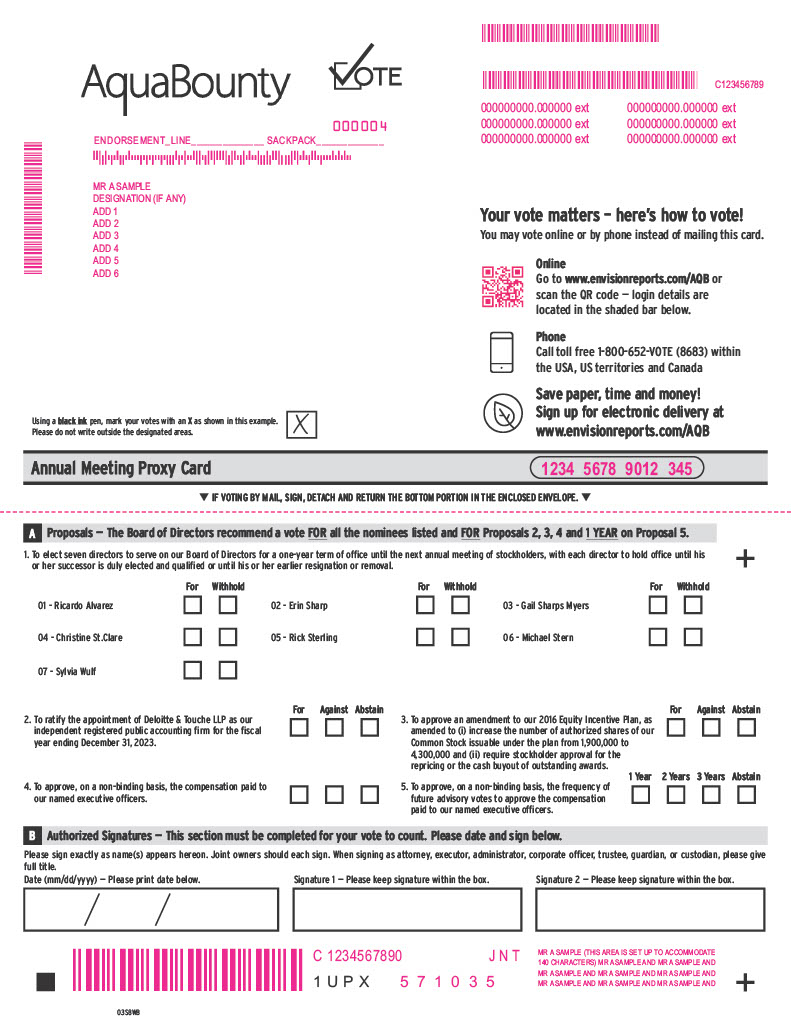

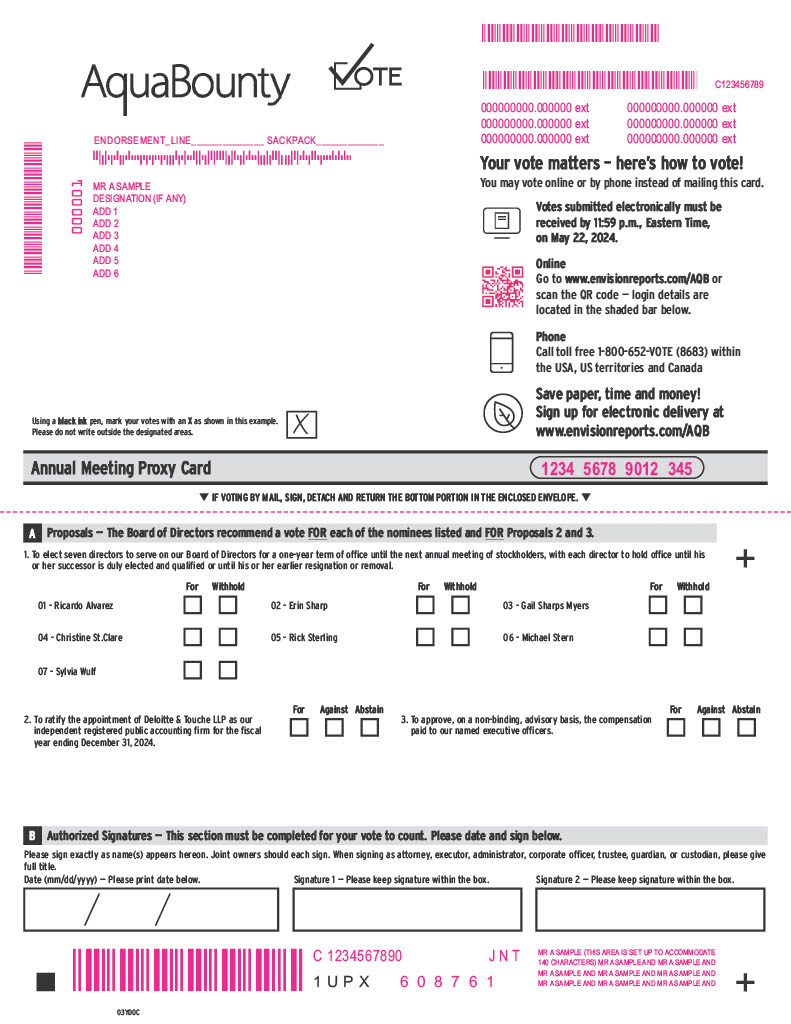

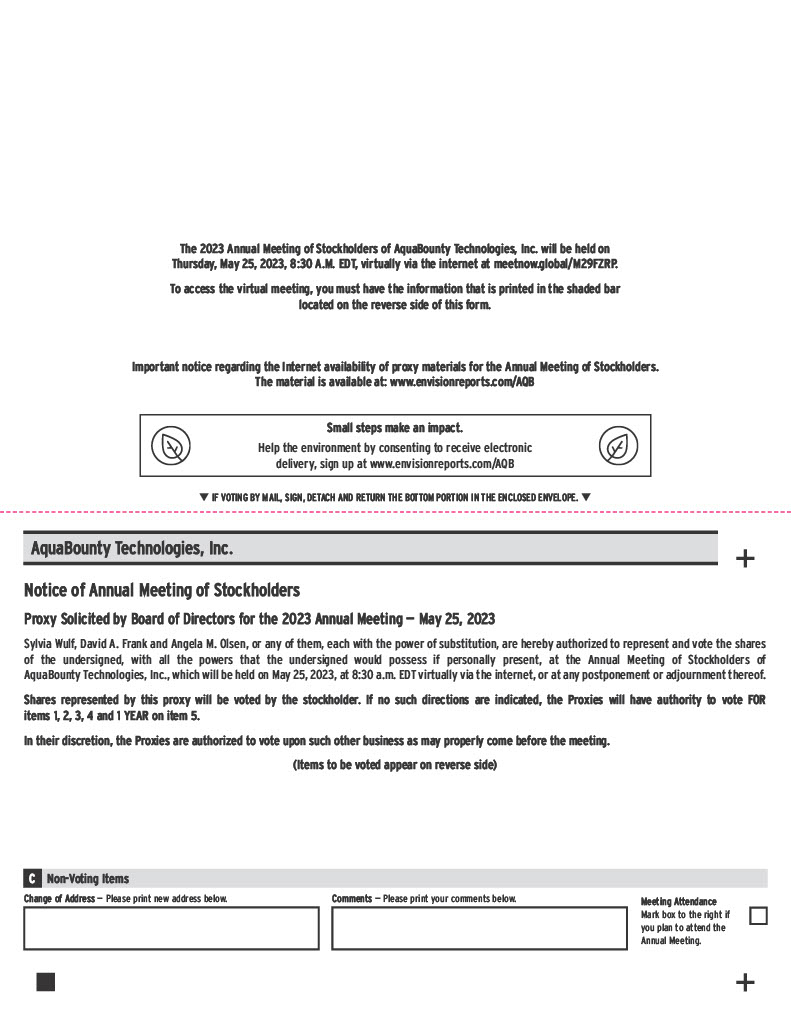

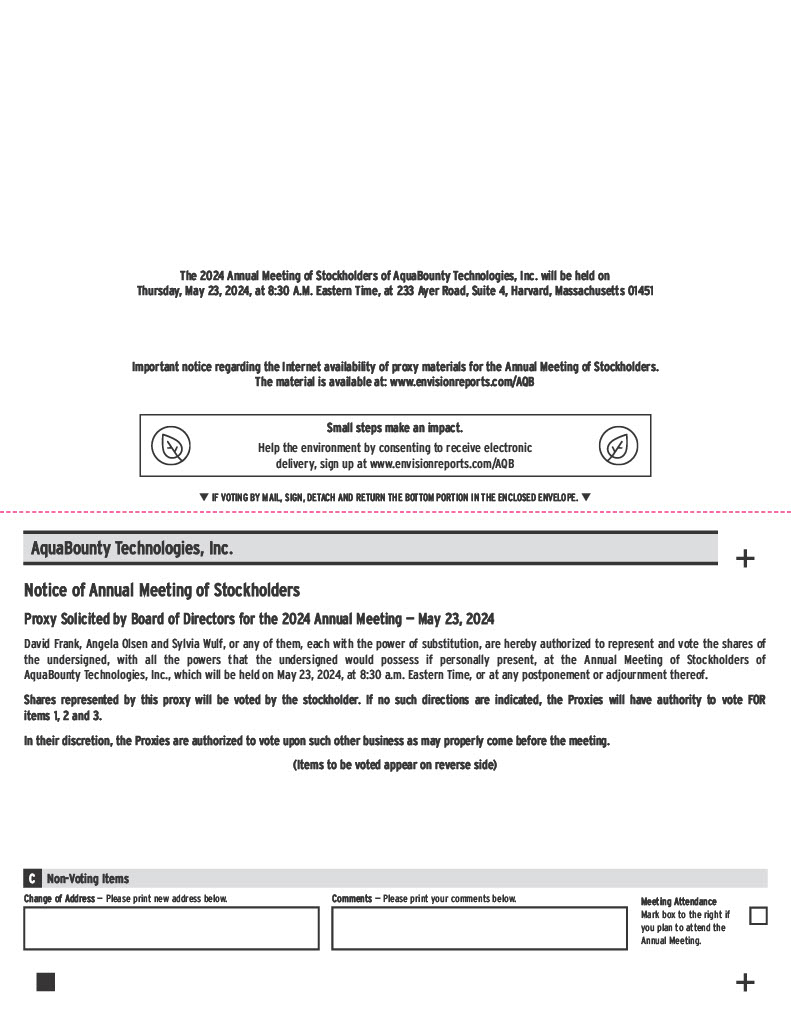

MAY 25, 2023 23, 2024

The 20232024 annual meeting of stockholders of AquaBounty Technologies, Inc. (“we,” “us,” “AquaBounty” or the “Company”) will be held on May 25, 2023,23, 2024, at 8:30 a.m., Eastern Time. The annual meeting will be held entirely online to support the health and well-being of our partners, employees, and stockholders. You will be able to attend and participate in the annual meeting by visiting www.meetnow.global/M29FZRP, where you will be able to listen to the meeting live, submit questions, and vote. This year’s meeting is being heldTime, at 233 Ayer Road, Suite 4, Harvard, MA 01451, for the following purposes:

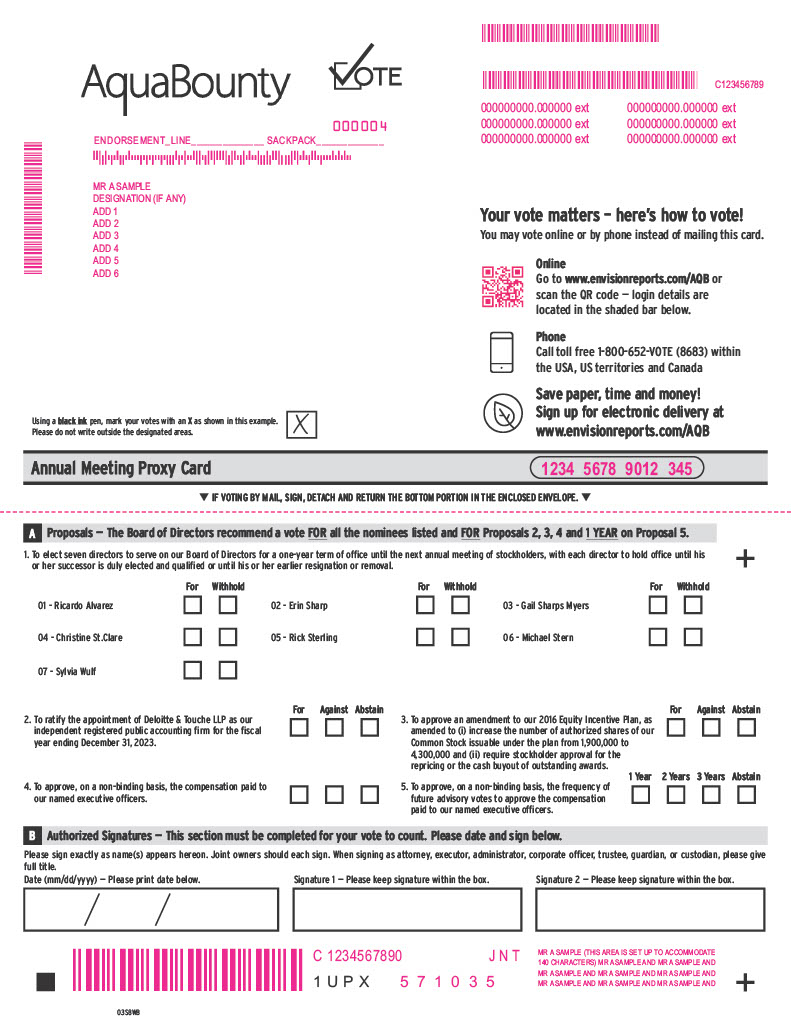

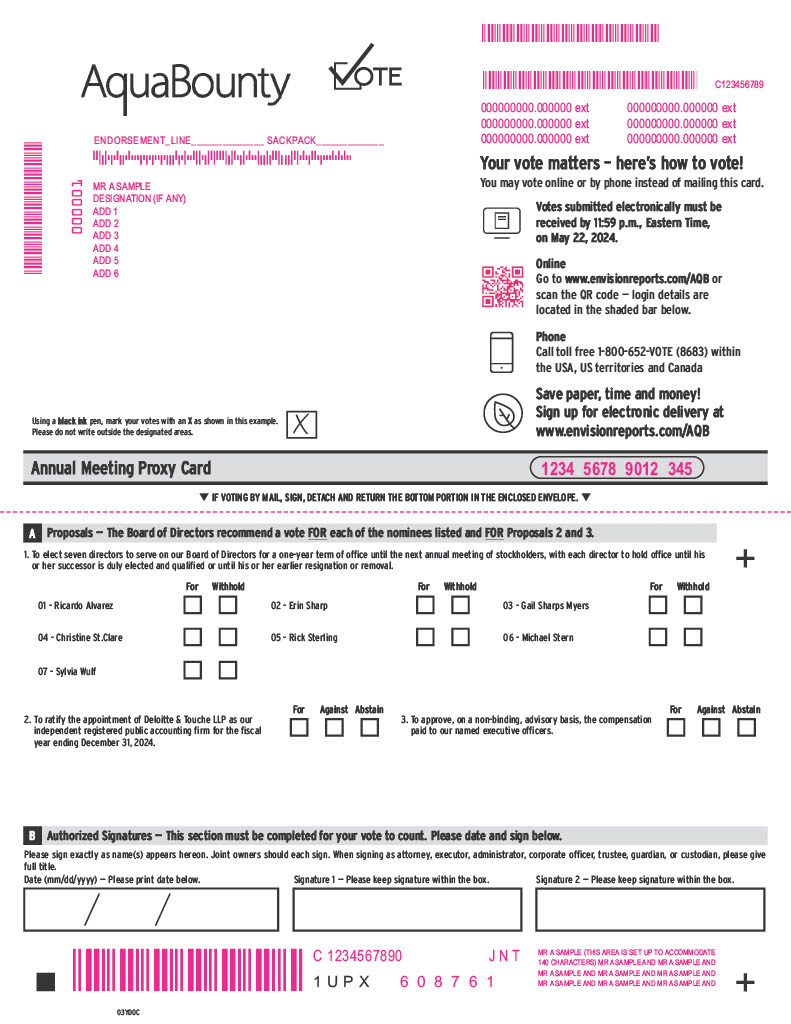

| · | | to elect seven directors to serve on our Board of Directors (our “Board”) for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal (“Proposal 1”); |

| · | | to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20232024 (“Proposal 2”); |

| ·

| | to approve an amendment to our 2016 Equity Incentive Plan, as amended (the “2016 EIP”), to (i) increase the number of authorized shares of our common stock, $0.001 par value per share (“Common Stock”), issuable under the 2016 EIP from 1,900,000 to 4,300,000, and (ii) require stockholder approval for the repricing of outstanding awards or the cash buyout of outstanding awards (“Proposal 3”);

|

| · | | to approve, on a non-binding, advisory basis, the compensation paid to our named executive officers (“Proposal 4”); |

| ·

| | to approve, on a non-binding advisory basis, the frequency of future advisory votes to approve the compensation paid to our named executive officers (“Proposal 5”3”); and

|

| · | | to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

After careful consideration, our Board recommends a vote “FOR” the election of each of the director nominees listed in Proposal 1 and a vote “FOR” Proposals 2 3 and 4, and a vote of “1 YEAR” for Proposal 5.3.

Only stockholders of record at the close of business on March 30, 2023,25, 2024, the record date, are entitled to notice of and to vote at the annual meeting or at any postponement(s) or adjournment(s) thereof.

Your vote is very important. Whether or not you plan to attend the annual meeting, online, we hope you will vote as soon as possible. Please vote before the annual meeting using the Internet; telephone; or by signing, dating, and mailing the proxy card in the pre-paid envelope, to ensure that your vote will be counted. Please review the instructions on each of your voting options described in the accompanying proxy statement. Your proxy may be revoked before the vote at the annual meeting by following the procedures outlined in the accompanying proxy statement.

| | |

| | Sincerely, |

| | |

| | Sylvia Wulf |

| | President, Chief Executive Officer and DirectorBoard Chair

|

| | |

Maynard,Harvard, Massachusetts

| | |

| | |

April 6, 20235, 2024 | | |

Forward-Looking Statements

This proxy statement contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended, that involve significant risks and uncertainties about AquaBounty. All statements other than statements of historical fact are forward-looking statements and AquaBounty may use words such as “expect,” “anticipate,” “project,” “intend,” “plan,” “aim,” “believe,” “seek,” “estimate,” “can,” “focus,” “will,” and “may,” similar expressions and the negative forms of such expressions to identify such forward-looking statements. We have based these forward-looking statements on our current expectations, assumptions, estimates, and projections. While we believe these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks, uncertainties, and other factors, many of which are outside of our control, which could cause our actual results, performance, or achievements to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. These statementsrisks and uncertainties include, but are not limited to: our history of net losses and the likelihood of future net losses; our ability to continue as a going concern; our expectations regardingability to raise substantial additional capital on acceptable terms, or at all, which is required to implement our personnel growth and risks of not approving and benefits of approving the Plan Amendment (as defined below). Among the important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are risks relating to, among other things, whetherbusiness strategy as planned, or not AquaBounty will be ableat all; our ability to raise additional capital, marketfunds in sufficient amounts on a timely basis, on acceptable terms, or at all; our ability to attract and retain key personnel, including key management personnel; our ability to retain and reengage key vendors and engage additional vendors, as needed; our ability to obtain approvals and permits to construct and operate our farms without delay; increases in interest rates; delays and defects that may prevent the commencement of farm operations; rising inflation rates; our ability to finance our Ohio farm through the placement of municipal bonds, which may require restrictive debt covenants that could limit our control over the farm’s operation and restrict our ability to utilize any cash that the farm generates; our ability to manage our growth, which could adversely affect our business; risks related to potential strategic acquisitions, investments or mergers; high customer concentration, which exposes us to various risks faced by our major customers; ethical, legal, and social concerns about genetically engineered products; our ability to gain consumer acceptance of our genetically engineered Atlantic salmon (“GE Atlantic salmon” or “AquAdvantage salmon”) product; the quality and quantity of the salmon that we harvest; a significant fish mortality event in our broodstock or our production facilities; the loss of our GE Atlantic salmon broodstock; disease outbreaks, which can increase the cost of production and/or reduce production harvests; a shutdown, material damage to any of our farms, or lack of availability of power, fuel, oxygen, eggs, water, or other key components needed for our operations; our ability to efficiently and cost-effectively produce and sell salmon at large commercial scale; any contamination of our products, which could subject us to product liability claims and product recalls; security breaches, cyber-attacks and other conditions, AquaBounty’sdisruptions could compromise our information, expose us to fraud or liability, or interrupt our operations; our dependence on third parties for the processing, distribution, and sale of our products; any write-downs of the value of our inventory; business, political, or economic disruptions or global health concerns; adverse developments affecting the financial services industry; industry volatility, including fluctuations in commodity prices of salmon; restrictions on Atlantic salmon farming in certain states; agreements that require us to pay a significant portion of our future revenue to third parties; our ability to receive additional government research grants and financial condition,loans; international business risks, including exchange rate fluctuations; our ability to use net operating losses and other tax attributes, which may be subject to certain limitations; our ability to maintain regulatory approvals for our GE Atlantic salmon and our farm sites and obtain new approvals for farm sites and the impactsale of general economic, public health, industry or political conditionsour products in other markets; our ability to continue to comply with U.S. Food and Drug Administration regulations and foreign regulations; significant regulations in the United Statesmarkets in which we intend to sell our products; significant costs complying with environmental, health, and safety laws and regulations, and any failure to comply with these laws and regulations; increasing regulation, changes in existing regulations, and review of existing regulatory decisions; lawsuits by non-governmental organizations and others who are opposed to the development or internationally. commercialization of genetically engineered products; risks related to the use of the term “genetically engineered,” which will need to be included as part of the acceptable market name for our GE Atlantic salmon, and bioengineering disclosures provided in accordance with U.S. Department of Agriculture regulations; competitors and potential competitors may develop products and technologies that make ours obsolete or garner greater market share than ours; any theft, misappropriation, or reverse engineering of our products could result in competing technologies or products; our ability to protect our proprietary technologies and intellectual property rights; our ability to enforce our intellectual property rights; volatility in the price of our shares of common stock; our ability to maintain our listing on the Nasdaq Stock Market LLC (“Nasdaq”); our success in growing, or our perceived ability to grow, our GE Atlantic salmon successfully and profitably at commercial scale; an active trading market for our common stock may not be sustained; our status as a “smaller reporting company” and a “non-accelerated filer” may cause our shares of common stock to be less attractive to investors; any issuance of preferred stock with terms that could dilute the voting power or reduce the value of our common stock; provisions in our corporate documents and Delaware law could have the effect of delaying, deferring, or preventing a change in control of us; our expectation of not paying cash dividends in the foreseeable future; and other risks and uncertainties discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

For additional disclosure regarding these and other risks faced by AquaBounty, see disclosures contained in AquaBounty’s public filings with the Securities and Exchange Commission,SEC, including the “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. You should consider these factors in evaluating the forward-looking statements included in this proxy statement and not place undue reliance on such statements. The forward-looking statements are made as of the date hereof, and AquaBounty undertakes no obligation to update such statements as a result of new information, except as required by law.

i

20232024 PROXY STATEMENT

TABLE OF CONTENTS

2 Mill & Main Place,233 Ayer Road, Suite 3954

Maynard,Harvard, Massachusetts 0175401451

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 25, 2023 23, 2024

ABOUT THE ANNUAL MEETINGMEETING

What is the Purpose of the Annual Meeting?

This proxy statement and the accompanying form of proxy are being made available to the stockholders of AquaBounty Technologies, Inc. (“we,” “us,” “AquaBounty” or the “Company”) in connection with the solicitation of proxies by our Board of Directors (“Board”) for use at our annual meeting of stockholders to be held on May 25, 2023,23, 2024, at 8:30 a.m., Eastern Time, at 233 Ayer Road, Suite 4, Harvard, MA 01451, and any adjournments, continuations or postponements thereof. The meeting will be held via a live webcast available at www.meetnow.global/M29FZRP, for the following purposes:

| · | | to elect seven directors to serve on our Board for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal (“Proposal 1”); |

| · | | to ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 20232024 (“Proposal 2”); |

| ·

| | to approve an amendment to our 2016 Equity Incentive Plan, as amended (the “2016 EIP”), to (i) increase the number of authorized shares of our common stock, $0.001 par value per share (“Common Stock”), issuable under the 2016 EIP from 1,900,000 to 4,300,000, and (ii) require stockholder approval for the repricing of outstanding awards or the cash buyout of outstanding awards (“Proposal 3”);

|

| · | | to approve, on a non-binding, advisory basis, the compensation paid to our named executive officers (“Proposal 4”); |

| ·

| | to approve, on a non-binding advisory basis, the frequency of future advisory votes to approve the compensation paid to our named executive officers (“Proposal 5”3”); and

|

| · | | to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

After careful consideration, our Board recommends a vote “FOR” the election of each of the director nominees listed in Proposal 1 and a vote “FOR” Proposals 2 3 and 4, and a vote of “1 YEAR” for Proposal 5.3.

Where can I obtain proxy-related materials and/or what should I do if I received more than one copy of the Notice and proxy materials?

A copy of our proxy materials is available, free of charge, on www.envisionreports.com/AQB, the Securities and Exchange Commission (“SEC”) website at www.sec.gov, and our corporate website at www.aquabounty.com. By referring to our website, we do not incorporate our website or any portion of that website by reference into this proxy statement. We have elected to provide access to our proxy materials over the Internet. Accordingly, on or about April 6, 2023,12, 2024, we expect to send a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of the record date entitled to vote at our annual meeting. The Notice will provide instructions on how to access our proxy statement and annual report, along with how to vote via the Internet or by telephone. Instructions on how to request a printed copy of the proxy materials will also be provideprovided in the Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help minimize our costs associated with printing and distributing our proxy materials and lessen the environmental impact of our annual meeting of stockholders.

If your shares are held in more than one account at a brokerage firm, bank, broker-dealer, or other similar organization (a “broker and/or other nominee”), you may receive more than one copy of the proxy materials. Please follow the voting instructions on the proxy cards or voting instruction forms, as applicable, and vote all proxy cards or voting instruction forms, as applicable, to ensure that all of your shares are voted. We encourage you to have all accounts registered in the same name and address whenever possible. If you are a registered holder, you can accomplish this by contacting our transfer agent, Computershare, at (800) 736-3001 or in writing to Computershare Investor Services, PO. Box 43078, Providence, Rhode Island 02940-3078. If your shares are held in an account at a broker and/or other nominee, you can accomplish this by contacting that organization.

Why did multiple stockholders at my address receive only one copy of the Notice and proxy materials?

Some broker and/brokers or other nominees may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Notice or set of proxy materials is being delivered to multiple stockholders sharing an address unless we have received contrary instructions. We will promptly deliver a separate copy of any of these documents to you if you write to us

at 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, MA 01754,01451, Attention: Corporate Secretary or call us at (978) 648-6000. If you want to receive separate copies of the Notice or proxy materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your broker and/or other nominee, or you may contact us at the above address or telephone number.

What is the quorum requirement to hold the annual meeting?

Our Common Stock is the only class of securities issued and outstanding, and each holder of our Common Stock is entitled to one vote for each share of the Common Stock standing in the name of such stockholder on the books of the Company on the record date for the annual meeting. Common stockholders of record at the close of business on March 30, 2023,25, 2024, the record date for the annual meeting, are entitled to notice of and to vote at the annual meeting. The holders of a majority of the stock issued and outstanding and entitled to vote as of the record date, present in person or represented by proxy, will constitute a quorum at the annual meeting. On March 30, 2023,25, 2024, the record date for the annual meeting, there were 71,338,9383,857,444 shares of Common Stock issued and outstanding.

For purposes of determining the presence or absence of a quorum, abstentions and broker non-votes will be counted as present. If a quorum is not present, or represented at the annual meeting, the stockholders entitled to vote at the annual meeting, present in person or represented by proxy, will have the power to adjourn the meeting from time to time until a quorum is present or represented.

What is the vote required for each of the proposals?

A summary of our annual meeting proposals and applicable vote standards is set forth below. Proposal 1 requires a plurality vote. Proposals 2 3, 4 and 53 require the affirmative vote of the holders of a majority of the stock present in person or represented by proxy at the meeting and entitled to vote. For Proposal 5, assuming a quorum is present, if a majority is not reached, the option that receives the most votes will be deemed the option selected by the stockholders.

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Proposal | | Vote Options | | Vote Required | | Effect of Withhold Votes or Abstentions | | Broker

Non-Votes (if any) | |

| | | | | |

Election of Directors (Proposal 1) | | FOR WITHHOLD | | At least one FOR vote. Nominees receiving the highest number of “FOR” votes are elected. Ifelected until all board seats are filled. In an uncontested election, where the number of nominees and available board seats are unopposed,equal, election requires only a single vote or more. | | No Effect | | No Effect | |

| | | | | |

Ratification of Appointment of Independent Auditors (Proposal 2) | | FOR AGAINST ABSTAIN | | Majority of shares present in person or represented by proxy at the meeting and entitled to vote on the proposal and which has actually been voted. | | Count as AGAINST voteNo Effect

| | No Effect (1) | |

| | | | | |

AmendmentAdvisory Vote to Approve the Compensation of our 2016 EIPNamed Executive Officers (Proposal 3)

| | FOR AGAINST ABSTAIN | | Majority of shares present in person or represented by proxy at the meeting and entitled to vote | | Count as AGAINST vote on the proposal and which has actually been voted.

| | No Effect | |

| | | | | |

Advisory Vote on Compensation of our Named Executive Officers (Proposal 4)

| | FOR

AGAINST

ABSTAIN

| | Majority of shares present and entitled to vote

| | Count as AGAINST vote

| | No Effect | |

| | | | | | | | | |

Advisory Vote on the Frequency of Future Advisory Votes on Compensation of our Named Executive Officers (Proposal 5)

| | ONE YEAR

TWO YEARS

THREE YEARS

ABSTAIN

| | The frequency receiving the votes of the holders of a majority of shares present and entitled to vote (2)

| | Count as AGAINST vote

| | No Effect

| |

| |

| |

(1) This proposal is considered to be a “routine” matter. Accordingly, if you beneficially own your shares and do not provide voting instructions, your broker and/or other nominee has discretionary authority to vote your shares on this proposal.

2 Accordingly, we do not expect there to be any broker non-votes on this proposal.

(2) Assuming a quorum is present, if a majority is not reached, the option that receives the most votes will be deemed the option selected by the stockholders.

Broker Non-Votes

If you are a beneficial owner of shares held by a broker and/or other nominee and you do not instruct your broker and/or other nominee how to vote your shares, your broker and/or other nominee may still be able to vote your shares in its discretion. Under the rules of the New York

Stock Exchange, which are also applicable to Nasdaq-listed companies, brokers and/or other nominees that are subject to New York Stock Exchange rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under New York Stock Exchange rules but not with respect to “non-routine” matters. A broker non-vote occurs when a broker and/or other nominee has not received voting instructions from the beneficial owner of the shares, and the broker and/or other nominee cannot vote the shares because the matter is considered “non-routine” under NYSE rules. Proposals 1 3, 4 and 53 are considered to be “non-routine” under New York Stock Exchange rules such that your broker and/or other nominee may not vote your shares on those proposals in the absence of your voting instructions. Conversely, Proposal 2 is considered to be a “routine” matter under New York Stock Exchange rules, and thus if you do not return voting instructions to your broker and/or other nominee by its deadline, your shares may be voted by your broker and/or other nominee in its discretion on Proposal 2.

Your Vote

Your vote is very important. Whether or not you plan to attend the annual meeting, please vote by proxy in accordance with the instructions on your proxy card or voting instruction card (from your broker and/or other nominee).

Stockholders of Record

If your shares are registered directly in your name with our transfer agent, Computershare, you are a stockholder of record, and you received the proxy materialsNotice by mail with instructions regarding how to view our proxy materials on the Internet, how to receive a paper or email copy of the proxy materials, and how to vote by proxy.proxy in advance of the meeting. You can also vote via the live webcast ofin person or by proxy during the annual meeting at www.meetnow.global/M29FZRP or by proxy.meeting. There are three ways stockholders of record can vote by proxy:proxy in advance of the meeting: (1) by telephone (by following the instructions on the proxy card;card); (2) by Internet (by following the instructions provided on the proxy card); or (3) by mail, (by completing and returning the proxy card enclosed in the proxy materials prior to the annual meeting). Unless there are different instructions, on the proxy card, all shares represented by valid proxies (and not revoked before they are voted) will be voted as follows at the annual meeting:

| · | | FOR the election of each of the director nominees listed in Proposal 1 (unless the authority to vote for the election of any such director nominee is withheld); |

| · | | FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm as described in Proposal 2; and |

| · | | FOR the approval, of an amendment to the 2016 EIP, as amended, to increase the number of authorized shares of Common Stock issuable from 1,900,000 to 4,300,000 and to require stockholder approval for the repricing of outstanding awards or the cash buyout of outstanding awards as described in Proposal 3; |

| ·

| | FOR the approval of theon a non-binding, advisory vote onbasis, of the compensation paid to our named executive officers as described in Proposal 4; and

|

| ·

| | FOR a vote of 1 YEAR for the frequency of future non-binding advisory votes on our named executive officers' compensation as described in Proposal 5.3.

|

If you provide specific voting instructions, your shares will be voted as instructed. Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day until the polls close during the meeting.

Beneficial Owners of Shares Held in Street Name

If your shares are held in an account at a broker and/or other nominee, then you are the beneficial owner of shares held in “street name,” and such organization forwarded to you the proxy materials. There are two ways beneficial owners of shares held in street name can vote by proxy in accordance withYou should follow the instructions provided to you by yourfrom such broker and/or other nominee: (1) by mail, by following the instructions on the voting instruction form; or (2) by Internet, by following the instructions on the voting instruction form.nominee in order to vote your shares.

Although we do not know of any business to be considered at the annual meeting other than the proposals described in the proxy statement, if any other business is presented at the annual meeting, your signed proxy or your authenticated Internet or telephone proxy will give authority to each of Sylvia Wulf, David A. Frank and Angela M. Olsen to vote on such matters at his or her discretion.

YOUR VOTE IS IMPORTANT. PLEASE VOTE WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON VIA THE LIVE WEBCAST.PERSON.

How do I attend the meeting?

This annual meeting will be held virtually. To attend and participate in the annual meeting, stockholders will need to access the live webcast of the meeting, available at www.meetnow.global/M29FZRP.

If youYou are a stockholder of record, you do not need to registerentitled to attend the annual meeting viaonly if you were a stockholder of record as of the live webcast. To attend, just follow the instructions on the noticerecord date, or proxy card that you received. We encourage you to access the meeting prior to the start time, leaving ample time for the check-in.

Ifif you are a beneficial owner“beneficial owner” of shares held in “street name” as of the record date and wish to attendyou hold a valid legal proxy for the annual meeting, whether you intend to voteexecuted in your shares at the meeting or not, you must register in advance to do so. To register, you must submit proof offavor by your proxy power (legal proxy from the broker and/or other nominee that holds your shares) reflecting your AquaBounty Technologies, Inc. holdings, along with your name and email address, to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:nominee. Registration will begin at 8:00 p.m.a.m., Eastern Time on May 22, 2023. You will receive a confirmationthe date of your registration by email after Computershare receives your registration materials. Requests for registration should be directed to Computershare as follows:

By email

Forward the email from your broker and/or other nominee, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail

Computershare

AquaBounty Technologies, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

To attend the annual meeting, as a “street name” holder, following registration, visit www.meetnow.global/M29FZRPand follow the instructions on the notice or proxy card that you received. Accessseating will begin immediately after. Since seating is limited, admission to the webcastannual meeting will beginbe on May 25, 2023 at 8:00 a.m. Eastern Time, and you should allow ample time for check-in.

Can I ask questions at the meeting?a first-come, first-served basis.

If you wishplan to submitattend, in addition to the legal proxy required if you are a question during the annual meeting and are entitled“beneficial owner” of your shares, please note that all attendees should be prepared to do sopresent government-issued photo identification for admittance, such as a stockholderpassport or driver’s license. In addition, if you are the “beneficial owner” of record or stockholder in “street name”your shares, you will also need proof of ownership as of the record date, you may log into, and submit a question on,such as the virtual meeting platformNotice, the voting instruction card provided by following the instructions provided through the platform. All questions presented should relate directly to the proposals under discussion. Questions from multiple stockholders on the same topicyour broker or that are otherwise related to a particular topic may be grouped, summarized and answered together. If questions submitted are irrelevant to the business of the annual meeting or are out of order or not otherwise suitable for the conduct of the annual meeting, as determined by the Chair or Corporate Secretary in their reasonable judgment, we may choose to not address them. If there are any matters of individual concern to a stockholder and not of general concern to all stockholders, or if a question posed was not otherwise answered, such matters may be raised separately after the annual meeting.

Our annual meeting will be governed by the meeting’s Rules of Conduct, which will address the ability of stockholders to ask questions during the meeting and rules for how questions will be recognized and addressed. The meeting’s Rules of Conduct will be available on the siteother nominee, your most recent account statement prior to the annual meeting.

Whatrecord date, or similar evidence of ownership. If you do I do if I experience technical issues during the meeting?

The virtual meeting platform is supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plug-ins. Note: Internet Explorer is not a supported browser. Participants should give themselves plenty of time to log in and ensure they have a strong Internet connection, and they can hear streaming audio prior to the startvalid picture identification or proof of the meeting.

Approximately 15 minutes prior to the startownership of and through the conclusion of the annual meeting, a support team willour stock, you may be ready to assist stockholders with any technical difficulties they may have in accessing or hearing the virtual meeting. If you encounter technical difficulties with the virtual meeting platform on the meeting day, please call the technical support number that will be posted on the meeting website.

Additional information regarding technical and logistical issues, including technical support duringdenied admission to the annual meeting, willmeeting. If you do not comply with each of the foregoing requirements, you may not be available on the meeting website, which stockholders should referadmitted to in the event that the annual meeting is adjourned or in the event of a technical failure or similar issue.meeting.

How do I revoke a proxy?

If you are a stockholder of record, you may revoke your proxy at any time before it is actually voted at the annual meeting by:

| · | | delivering written notice of revocation to our Corporate Secretary at 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, Massachusetts 01754,01451, which must be received by our Corporate Secretary prior to the start of the annual meeting; |

| · | | submitting a later-dated proxy prior to the applicable cutoff times, as described above; or |

| · | | attending the annual meeting via the live webcast available at www.meetnow.global/M29FZRPand voting.voting in person. |

Your attendance at the annual meeting will not, by itself, constitute a revocation of your proxy. You may also be represented by another person attending the annual meeting by executing an acceptable form of proxy designating that person to act on your behalf.

Shares may only be voted by or on behalf of the record holder of shares as of the record date, as indicated in our stock transfer records. If your shares are held in “street name,” then you must provide voting instructions to the broker and/or other nominee, as the appropriate record holder, so that such person can vote the shares in accordance with your preferences. In the absence of such voting instructions from you, the record holder will be entitled to vote your shares on “routine” matters. Pleaseplease contact your broker and/or other nominee if you would like directions on how you may change or revoke your voting instructions.

Who is making this solicitation?

This solicitation is made on behalf of our Board, and we will pay the costs of solicitation. Copies of solicitationproxy materials will be furnished to brokers and/or other nominees holding shares in their names that are beneficially owned by others so that they may forward the solicitation materialproxy materials to such beneficial owners upon request. We will reimburse brokers and/or other nominees for reasonable expenses incurred by them in sending proxy materials to our stockholders. In addition to the solicitation of proxies by mail, our directors, officers, and employees may solicit proxies by telephone, facsimile, or personal interview. No additional compensation will be paid to these individuals for any such services. We have engaged a third-party solicitor, Georgeson LLC, who may solicit proxies by telephone or by other means of communication on our behalf. The cost for this service is estimated at $20,000, including expenses. In addition, we have agreed to indemnify Georgeson LLC against certain claims, liabilities, losses, damages and expenses arising out of or in connection with these services.

How can I find the voting results?

We plan to announce preliminary voting results at the meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the annual meeting.

Stockholder Proposals for 20242025 Annual Meeting

Stockholder proposals that are intended to be presented at our 20242025 annual meeting of stockholders and included in our proxy statement relating to the 20242025 annual meeting, pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must be received by us no later than December 8, 2023,13, 2024, which is 120 calendar days before the anniversary of the date on which this proxy statement was first distributed to our stockholders. If the date of the 20242025 annual meeting is moved more than 30 days from the date of the 20232024 annual meeting, the deadline for inclusion of proposals in our proxy statement for the 20242025 annual meeting instead will be a reasonable time before we begin to print and send our proxy materials. All stockholder proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for the 20242025 annual meeting. To comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 no later than March 24, 2024.

If a stockholder wishes to request business be brought at our 20242025 annual meeting of stockholders (other than matters included in our proxy statement in accordance with Rule 14a-8 under the Exchange Act), the stockholder must give advance notice to us prior to the deadline (the “Bylaw Deadline”) for the annual meeting determined in accordance with our Amended and Restated Bylaws (“bylaws”) and comply with certain other requirements specified in our bylaws. Under our bylaws, in order to be deemed properly presented, the notice of a proposal, including nominations for the election of directors, must be delivered to our Corporate Secretary no later than February 21, 2024,26, 2025, which is 45 calendar days prior to the first anniversary of the date on which we mailed the proxy materials for the 20232024 annual meeting.

However, if we change the date of the 20242025 annual meeting so that it occurs more than 30 days prior to, or more than 30 days after, May 25, 2024,23, 2025, stockholder proposals intended for presentation at the 20242025 annual meeting, but not intended to be included in our proxy statement relating to the 20242025 annual meeting, must be delivered to or mailed and received by our Corporate Secretary at 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, Massachusetts 0175401451 no later than the close of business on the ninetieth90th calendar day prior to the 20242025 annual meeting or the twentieth 20thcalendar day following the day on which public disclosure of the date of the 20242025 annual meeting is first made (the “Alternate Date”). We also encourage you to submit any such proposals via email to investors@aquabounty.com. If a

stockholder gives notice of such proposal after the Bylaw Deadline (or the Alternate Date, if applicable), the stockholder will not be permitted to present the proposal to the stockholders for a vote at the 20242025 annual meeting. Additional requirements applicable to notices of stockholder proposals are set forth in our bylaws. In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

We have not been notified by any stockholder of his or her intentthat such stockholder intends to present a stockholder proposal from the floor at this annual meeting. The enclosed proxy grants the proxy holders discretionary authority to vote on any matter properly brought before the annual meeting or any adjournment or postponement thereof.

In connection with our solicitation of proxies for our 2025 annual meeting of stockholders, we intend to file a proxy statement and WHITE proxy card with the SEC. Stockholders may obtain our proxy statement (and any amendments and supplements thereto) and other documents as and when filed with the SEC without charge from the SEC’s website at www.sec.gov.

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL 1:

ELECTION OF DIRECTORSDIRECTORS

Our Board recommends that the stockholders vote FOR

the election of EACH OF THE director nominees listed below.

Our Charter provides for the appointment toEach director serving on our Board of up to nine directors, who areis elected for a one-year term to hold office until the next annual meeting of our stockholders until the election and qualification of his or until removed from office in accordance with our bylaws.her successor, subject to his or her earlier death, disqualification, resignation or removal. The nominees named below have agreed to serve if elected, and we have no reason to believe that they will be unavailable to serve. If, however, the nominees named below are unable to serve or decline to serve at the time of the annual meeting, the proxies will be voted for any nominee who may be designated by our Board. Richard J. Clothier is not standing for re-election at the annual meeting, and as a result, his term as director will end at the annual meeting. We expect that the sitting directors will elect a new Board Chair subsequent to the annual meeting, pursuant to our bylaws. Unless a stockholder specifies otherwise, a returned, signed proxy will be voted FOR the election of each of the nominees listed below.

The following table sets forth information with respect to the persons nominated for re-election at the annual meeting:

| | | | | | | | | | | | |

| | Director | | Committees | | Director | | Committees |

Name | Age | Since | Position(s) | Audit | Comp | Nom-Gov | Age | Since | Position(s) | Audit | Comp | Nom-Gov |

Ricardo J. Alvarez | 67 | 2021 | Director | | Mem | Chair | 68 | 2021 | Lead Independent Director | | Mem | Chair |

Erin Sharp | 65 | 2022 | Director | Mem | | | 66 | 2022 | Director | Mem | | |

Gail Sharps Myers | 53 | 2021 | Director | Mem | Chair | | 54 | 2021 | Director | Mem | Chair | |

Christine St.Clare | 72 | 2014 | Director | Chair | | Mem | 73 | 2014 | Director | Chair | | Mem |

Rick Sterling | 59 | 2013 | Director | Mem | Mem | | 60 | 2013 | Director | Mem | Mem | |

Michael Stern | 62 | 2022 | Director | | | Mem | 63 | 2022 | Director | | | Mem |

Sylvia A. Wulf | 65 | 2019 | Director, CEO and President | | | | 66 | 2019 | Board Chair and CEO | | | |

Ricardo J. Alvarez. Dr. Alvarez joined the Board of AquaBounty in March 2021. He is currently the CEO of Hans Kissle Foods, a leading manufacturer of fresh prepared foods. Prior to joining Hans Kissle, he served as CEO of J&K Ingredients, a leading manufacturer of bakery ingredients globally. Prior to J&K Ingredients, he servedglobally, and as President and CEO of various food manufacturing companies including Passport Foods (SVC), LLC, Richelieu Foods, Ruiz Foods, Anita'sAnita’s Foods, Overhill Farms and Raymundo'sRaymundo’s Food Products. In his 2530 years as a leader in the packaged food industry, Dr. Alvarez has implemented growth strategies including new go-to-market initiatives, geographic expansion and innovations of both product and packaging. Dr. Alvarez also has extensive board experience, having served on the boards of Bush Brothers Inc., Clement Pappas Inc., Ruiz Foods and Clear Springs Foods. He currently serves on the board of Phelps Pet Products Inc. Dr. Alvarez brings operational and food industry experience to our Board.

Erin Sharp. Ms. Sharp joined the Board of AquaBounty in May 2022 and recently retiredafter retiring as Group Vice President of Manufacturing and Enterprise Sourcing for The Kroger Co. (NYSE: KR), where she was a Senior Officer having responsibility for companywide manufacturing, food safety and sourcing. Prior to her 10 years with The Kroger Co,Co., Ms. Sharp had increasing leadership roles in operations and finance with several large consumer product companies; including Sara Lee, Nestle Dreyer’s and Frito Lay. She served as a board member for the national nonprofit organization Feeding America as well as several industry boards including American Bakers Association, where she was the first female Chair, MilkPEP and the International Dairy Association. Ms. Sharp earned a bachelor’s degree from the University of Western Ontario and a Master’s inMaster of Business Administration from the University of Texas. Ms. Sharp brings operational and food industry experience to our Board.

Gail Sharps Myers. Ms. Sharps Myers joined the Board of AquaBounty in May 2021. She has beenis the Executive Vice President, Chief Legal and Administrative Officer and Chief People OfficerCorporate Secretary at Denny’s Corporation (NASDAQ:DENN), since February 2021. She previously served as Senior Vice President, General Counsel2024, and Secretary of Denny’sshe has held senior executive roles at the company since September 2020 and as Senior Vice President and General Counsel from June 2020 to September 2020. Prior to joining Denny’s, she served as Executive Vice President, General Counsel, Chief Compliance Officer and Secretary of American Tire Distributors, Inc. from May 2018 to May 2020, as Senior Vice President, General Counsel and Secretary at Snyder’s-Lance, Inc. (NASDAQ:LNCE) from January 2015 to March 2018 and as Senior Vice President, Deputy General Counsel, Chief Compliance Counsel and Assistant Secretary from 2014 to 2015 at US Foods, Inc. She received her Doctor of Jurisprudence from The Washington College of Law at The American University, her Master’s inMaster of Business Administration from Arizona State University'sUniversity’s W. P. Carey School of Business and her Bachelor of Arts in Political Science at Howard University. Ms. Sharps Myers’ experience and background make her well suited to serve on our Board.

Christine St.Clare. Ms. St.Clare joined the Board of AquaBounty in May 2014. She is a former Audit Partner at KPMG LLP (“KPMG”) serving publicly traded companies until 2005, after which she transferred to the Advisory Practice, working in the Internal Audit, Risk and Compliance Practice until her retirement in 2010. She also served a four-year term on KPMG’s Board of Directors,

where she chaired KPMG’s Audit and Finance Committee for three of the four years. She has served on the Board of Directors for Tilray, Inc. (“Tilray”) (NASDAQ:TLRY), from their 2018 IPO through April 2021. At Tilray, she chaired the Audit Committee and was a member of the Nominating & Governance Committee and the Compensation Committee. She formerly served on the boards of both Fibrocell Science, Inc. (“Fibrocell”), a company that specialized in the development of personalized biologics and Polymer Group, Inc. (“Polymer”), a global manufacturer of engineered materials. Fibrocell was a NASDAQ listed company and Polymer was a Blackstone portfolio company with publicly traded debt. For both Fibrocell and Polymer, Ms. St.Clare served as the Audit Committee Chair until their respective sales to strategic buyers. Ms. St.Clare holds a Bachelor of Science in accountingAccounting from California State University at Long Beach and has been a licensed Certified Public Accountant in California, Texas and Georgia. Ms. St.Clare’s background in accounting and support of publicly held companies, as well as her experience with biotechnology, makes her well suited for service on our Board.

Rick Sterling. Mr. Sterling has served on the Board of AquaBounty since September 2013. He served as the Chief Financial Officer at Precigen Inc. (NASDAQ:PGEN) (“Precigen”) from 2007 through March 2021, including leading them through their initial public offering in 2013. During his term at Precigen, Mr. Sterling was responsible for multiple private and public equity and debt capital raises, financial diligence for and integration of over a dozen acquisitions, SEC reporting and compliance, divestitures of businesses, budgeting, and negotiations of facility leases as well as oversight of human resource and information technology functions. Prior to joining Precigen, he was with KPMG where he worked in the audit practice for over 17 years, with a client base primarily in the healthcare, technology and manufacturing industries. He has a Bachelor of Science in Accounting from Virginia Tech and is a licensed Certified Public Accountant. Mr. Sterling’s background in audit and finance, as well as his experience with technology companies, make him well suited for service on our Board.

Michael Stern. Dr. Stern joined the Board of AquaBounty in May 2022 and is the former CEO of The Climate Corporation and Digital Farming for Bayer Crop Science (“Bayer”) and a member of the Crop Sciences Executive Team. Before joining Bayer, Dr. Stern had a 30-year career at Monsanto Company (NYSE:MON) (“Monsanto”), where he was a member of Monsanto’s Executive Team and led their Row Crop Business in the Americas. In addition, Dr. Stern served in a variety of leadership roles at Monsanto, including Vice President of U.S. Seeds and Traits, President of American Seeds, CEO of Renessen LLC, a biotechnology joint venture with Cargill, and Director of Technology for Agricultural Productivity. Dr. Stern is a member of the Board of Directors of Lavoro Limited (“LVRO”).Limited. Dr. Stern also serves as Chairman of the Board of Trustees for the Missouri Botanical Garden and served on the board of the Monsanto Fund and the board of Clara Foods, a San Francisco based company focused on developing novel animal proteins from cell culture. Dr. Stern received a Ph.D. in Chemistry from Princeton University, a MSMaster of Science in Chemistry from the University of Michigan and a BSBachelor of Science degree from Denison University. Dr. Stern’s brings broad experience in the food industry and biotechnology to our Board.

Sylvia Wulf. Ms. Wulf was appointed Executive Director, President, and Chief Executive Officer of AquaBounty in January 2019. In 2023, Ms. Wulf was elected Chair of the Board of AquaBounty, and she relinquished her position as President, as part of the Company’s leadership progression process. Prior to joining AquaBounty, Ms. Wulf served as a Senior Vice President of US Foods, Inc. (NYSE:USFD), where she had been President of the Manufacturing Division since June 2011. Prior to US Foods, Ms. Wulf held senior positions in Tyson Foods, Inc. (NYSE:TSN), Sara Lee Corporation, and Bunge Corp (NYSE:BG). She is also currently on the Board of Directors and the Executive Committee of both the National Fisheries Institute and the Biotechnology Industry Organization. Ms. Wulf received a Bachelor of Science in Finance from Western Illinois University and a Master’s inMaster of Business Administration from DePaul University. Ms. Wulf provides extensive experience in the food industry in North America, including its fish sector to our Board.

Our Executive Officers

The following table identifies our executive officers who are not members of our Board and sets forth their current positions with us.

| | | | | | |

Name | Age | Officer Since | Position(s) | Age | Officer Since | Position(s) |

David F. Melbourne | | 57 | 2022 | President |

David A. Frank | 62 | 2007 | Chief Financial Officer and Treasurer | 63 | 2007 | Chief Financial Officer and Treasurer |

Angela Olsen | 54 | 2019 | General Counsel and Corporate Secretary | |

Alejandro Rojas | 61 | 2014 | Chief Operating Officer, AquaBounty Farms | |

Angela M. Olsen | | 55 | 2019 | General Counsel and Corporate Secretary |

David F. Melbourne. Mr. Melbourne was appointed President of AquaBounty in August 2023. He joined AquaBounty in June 2019 as Chief Commercial Officer with a background in general management, operations/commercial management and innovation. His 25 years of experience in the seafood industry spans both wild fisheries and aquaculture. He served as Senior Vice President, Consumer Marketing/Government & Industry Relations/Corporate Social Responsibility at Bumble Bee Foods, LLC from 2005 to 2019.

David A. Frank. Mr. Frank was appointed Chief Financial Officer and Treasurer of AquaBounty in October 2007. Prior to joining AquaBounty, he served as Chief Financial Officer of Magellan Biosciences and President of TekCel between 2003 and 2007.

Angela M. Olsen. Ms. Olsen was appointed General Counsel and Corporate Secretary in November 2019. Prior to joining AquaBounty, she served as Senior Advisor and Associate General Counsel at E.I. du Pont de Nemours and Company (NYSE:DD) between 20172010 and 2019.

Alejandro Rojas. Mr. Rojas joined AquaBounty as the Chief Operating Officer of AquaBounty Farms (our wholly owned subsidiary) in February 2014.

Our executive officers are elected by our Board and hold office until removed by the Board, andor until their successors have been duly elected and qualified or until their earlier resignation, retirement, removal, or death. The principal occupation and employment during the past five years of each of our executive officers was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our executive officers and any other person or persons pursuant to which they were or are to be selected as an executive officer. There are no material legal proceedings to which any of our executive officers or any associate of any such executive officer is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Corporate Governance Principles

We are committed to having sound corporate governance principles. Having such principles is essential to maintaining our integrity in the marketplace. Our Code of Business Conduct and Ethics and the charters for each of the Audit, Compensation and Human Capital, and Nominating and Corporate Governance (“NCG”) Committees are available on the investor relations section of our corporate website (www.aquabounty.com). A copy of our Code of Business Conduct and Ethics and the committee charters may also be obtained upon request to Corporate Secretary, AquaBounty Technologies, Inc., 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, Massachusetts 01754.01451.

Environmental, Social and Governance

Historically, we have viewed the focus onWe believe Environmental, Social and Governance (“ESG”) concerns as foundational to a well-run business andare fundamental to our Purpose and Values as welland serve as a critical aspect offoundation to how we operate our business, deliver resultsbusiness. Our focus on ESG has been instrumental in driving continuous improvement and drive continuous improvement. We embraced ESG early in the development of our business practices, as we see it as a critical component to building our culture, and as a strategic imperative for identifyinghas resulted in increased efficiencies and effectiveness as we grow. The ESG reporting requirements and norms will continue to evolve and we will continue to monitor those changes.throughout our operations. We believe that taking ESG considerations into account in our decision-making process ensures a disciplined approach to risk management.

Our ESG Committee, which is comprised of our executive management team, with oversight by our Board of Directors, has worked cross functionally to develop our strategy, structure, processesprocess and the roadmap for the standards that are relevant to our business.

In 2021, Currently, we took an important step in our corporate governance evolution by committing to deeper understanding of material non-financial matters of our business across ESG aspects. We deployed a rigorous process where we identified and interviewed external advisors/consulting groups that would provide expertise to assist in developing and implementing our ESG initiatives and selected a qualified strategic counsel and partner. We also identified and implemented a digital system platform to track data inputs used for reporting calculations and to ensure we are collecting data and other ESG inputs on a consistent and ongoing basis.

Following a thorough review of the various ESG reporting standards, we selected the SASB Framework as our primary standard, as the accounting metrics for the Food Sector contain topics that are more specific and pertinent to our business model and operations during the current reporting period. Additionally, our program and reporting incorporate alignment with several applicable GRI metrics and the United Nations Sustainable Development Goals (“UNSDGs”). In our initial ESG materiality assessment we chosechoose to focus on the ESG aspects of (i) energy and water management; (ii) consumer welfare and employee health and safety; and (iii) diversity and inclusion, humane and considerate animal welfare, and sound governance and oversight structure.

For more information on Additionally, our ESG efforts, please read our Annual Report on Form 10-K forframework is aligned with a number of the year ended December 31, 2022.United Nations Sustainable Development Goals.

Code of Ethics

Our Board has adopted the Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including, but not limited to, our Chief Executive Officer and Chief Financial Officer and other executive and senior financial officers. The Code of Business Conduct and Ethics constitutes our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act and is our “code of conduct” within the meaning of the listing standards of The Nasdaq Stock Market LLC (“Nasdaq”). Our Code of Business Conduct and Ethics is posted to our website, and we intend to disclose any amendment or waiver of a provision thereof that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing

similar functions, by posting such information on our website (available at www.aquabounty.com) and/or in our public filings with the SEC. During fiscal year ended December 31, 2022,2023, no waivers were granted from any provision of the Code of Business Conduct and Ethics.

Policy on Trading, Pledging and Hedging of Our Common Stock

Certain transactions in our securities (such as purchases and sales of publicly traded put and call options, and short sales) create a heightened compliance risk or could create the appearance of misalignment between management and stockholders. In addition, securities held in a margin account or pledged as collateral may be sold without consent if the owner fails to meet a margin call or defaults on the loan, thus creating the risk that a sale may occur at a time when an officer or director is aware of material, nonpublicnon-public information or otherwise is not permitted to trade in Company securities. Our insider trading policy expressly prohibits short sales and

derivative transactions of our stock by our employees, officers and directors, including hedging short sales of our securities and the purchase or sale of puts, calls, or other derivative securities of the Company or any derivative securities that provide the economic equivalent of ownership. To our knowledge, each of our directors and executive officers complied with this policy during 2022.2023.

Stockholder Communications with Directors

Stockholders may communicate with our directors by sending communications to the attention of the ChairmanChair of the Board, the ChairpersonChair of a committee of the Board, or an individual director via U.S. Mail or Expedited Delivery Services to our address at AquaBounty Technologies, Inc., 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, Massachusetts 01754.01451. The Company will forward by U.S. Mail any such communication to the mailing address most recently provided by the Board member identified in the “Attention” line of the communication. All communications must be accompanied by the following information:

| · | | A statement of the type and amount of the securities of the Company that the submitting individual holds, if any; |

| · | | Any special interest, other than in the capacity of security holder, of the submitting individual in the subject matter of the communication; and |

| · | | The address, telephone number, and email address of the submitting individual. |

Board Composition

Our Charter provides for the appointment toEach director serving on our Board of up to nine directors who areis elected for a one-year term to hold office until the next annual meeting of our stockholders until the election and qualification of his or until removed from office in accordance with our bylaws.her successor, subject to his or her earlier death, disqualification, resignation or removal. The authorized number of directors may be changed by resolution of the Board. The Board has the power to appoint any person as a director to fill a vacancy on the Board.

Board Independence

As required by the Nasdaq listing rules, our Board evaluates the independence of its members at least once annually and at other appropriate times when a change in circumstances could potentially impact the independence or effectiveness of one of our directors.

In February 2023,2024, our Board undertook a review of the composition of our Board and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment, and affiliations, including family relationships, our Board has determined each of Mses. St.Clare, Sharps Myers and Sharp, and Messrs. Clothier, Alvarez, Sterling and Stern are eachis an “independent director” as defined under Nasdaq Listing Rule 5605(a)(2).

Board Leadership Structure

Our Board understands that board structures vary greatly among U.S. public corporations, and our Board does not believe that any one leadership structure is more effective at creating long-term stockholder value. Our Board believes that an effective leadership structure could be achieved either by combining or separating the Board Chair and Chief Executive Officer positions, so long as the structure encourages the free and open dialogue of competing views and provides for strong checks and balances. Specifically, the Board believes that, to be effective, the governance structure must balance the powers of the Chief Executive Officer and the independent directors and ensure that the independent directors are fully informed, able to discuss and debate the issues that they deem important, and able to provide effective oversight of management.

Currently, our Board separatescombines the roles of Chief Executive Officer and Board Chair and the latterbut has appointed a Lead Independent Director who is elected by the independent directors. The Lead Independent Director serves as a liaison between the independent directors and the Chief Executive Officer and Board Chair, and leads executive sessions of Board meetings consisting of only the independent directors. The role of President has been assumed by a member of the executive leadership team. Our Board believes that this leadership structure is appropriate for the companyCompany at this time because it allows the Chief Executive OfficerPresident to focus on operating and managing the company.day-to-day operations of the Company. At the same time, the Chief Executive Officer and Board Chair can focus on corporate strategy and leadership of the Board, including calling and presiding over Board meetings and executive sessions of the independent directors, preparing meeting agendas in collaboration with the Chief Executive Officer, serving as a liaison and supplemental channel of communication between

independent directors and the Chief Executive Officer, and serving as a sounding board and advisor to the Chief Executive Officer.Board. We believe this structure is appropriate given the size of our executive officer team and our growth trajectory in an evolving industry.

Nevertheless, the Board believes that “one size” does not fit all, and the decision of whether to combine or separate the positions of Chief Executive Officer and Board Chair will vary and depend upon our particular circumstances at a given point in time, taking into consideration the depth and breadth of the executive officer team and the composition of the Board.

Board’s Role in Risk Oversight

Our Board is actively engaged in the oversight of the risks we face and consideration of the appropriate responses to those risks. However, our Board delegates certain of such responsibilities to its committees. The Audit Committee is responsible for reviewing with management our company’sCompany’s policies and procedures with respect to risk assessment and risk management, including reviewing certain risks associated with our financial and accounting systems, accounting policies, investment strategies, regulatory compliance, insurance programs, and other matters. The Audit Committee also reviews and comments on a periodic risk assessment performed by management. After the Audit Committee performs its review and comment function, it reports any significant findings to our Board. The Board is responsible for the oversight of our risk management programs and, in performing this function, receives periodic risk assessment and mitigation initiatives for information and approval as necessary. In addition, under the direction of our Board and certain of its committees, our legal department assists in the oversight of corporate compliance activities. The Compensation and Human Capital Committee also reviews certain risks associated with our overall compensation program for employees to help ensure that the program does not encourage employees to take excessive risks.

Currently, our management team conducts an annual risk assessment that is led by our Chief Compliance Officer and provided to our Board as part of their oversight responsibility. The process includes input from all executive officers and senior managers with all identified risks reviewed by our Disclosure Committee to ensure that all risks are accurately disclosed in our public filings. Identified risks, along with mitigation plans are reviewed with our outside advisors and reported to our Board on an annual basis with quarterly updates.

Board Meeting Attendance

During 2022,2023, our Board met six11 times, and each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which such director served. Members of the Board and its committees also consulted informally with management from time to time. Additionally, non-management Board members met in executive sessions without the presence of management periodically during 2022.2023. We do not have a formal policy regarding board members’ attendance at our annual meetings of stockholders but encourage them to do so; all did in 2022.so. Our 2023 annual meeting of stockholders was attended by one member of our Board.

Board Diversity

We strive to have a Board with race, ethnicity and gender diversity that represents our community and brings diverse ideas and backgrounds to the table.

The table below provides the Diversity Matrix for our Board:

| | | | |

Board Diversity Matrix (as of April 6, 2023) | |

Board Diversity Matrix (as of April 5, 2024) | | Board Diversity Matrix (as of April 5, 2024) |

Total Number of Directors | 8 | 7 |

| Female | Male | Non-Binary | Did Not Disclose | Female | Male | Non-Binary | Did Not Disclose Gender |

Part I: Gender Identity | | |

Directors | 4 | 0 | 0 | 4 | 3 | 0 | 0 |

Part II: Demographic Background | | |

African American or Black | 1 | 0 | 0 | 1 | 0 | 0 |

Alaskan Native or Native American | 0 | 0 | 0 | 0 |

Asian | 0 | 0 | 0 | 0 |

Hispanic or Latinx | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 0 |

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

White | 3 | 0 | 0 | 3 | 2 | 0 | 0 |

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

LGBTQ+ | 0 | 1 |

Did Not Disclose Demographic Background | 0 | 0 |

Board Committees

Our Board has three standing committees: the Audit Committee (“AC”), the Compensation and Human Capital Committee (“CHCC”), and the NCGNominating and Corporate Governance Committee (“NCGC”), each of which operate pursuant to a written charter adopted by our Board that is available on our corporate website (www.aquabounty.com) under “Investor Relations.”

Audit Committee. Mses. St.Clare, Sharps Myers, Sharp and Mr. Sterling serve as members of our Audit Committee,AC, and Ms. St.Clare serves as its chair. Each member of the Audit CommitteeAC satisfies the special independence standards for such committee established by the SEC and Nasdaq, as applicable. Ms. St.Clare is an “audit committee financial expert,” as that term is defined by the SEC in Item 407(d) of Regulation S-K. Stockholders should understand that this designation is an SEC disclosure requirement relating to Ms. St.Clare’s experience and understanding of certain accounting and auditing matters, which the SEC has stated does not impose on the director so designated any additional duty, obligation, or liability than otherwise is imposed generally by virtue of serving on the Audit CommitteeAC and/or our Board. No Audit CommitteeAC member is permitted to serve on the audit committee of more than two other public companies, unless the Board determines that such simultaneous service would not impair the ability of the Audit CommitteeAC member to effectively serve on our Audit Committee.AC. Our Audit CommitteeAC is responsible for, among other things, oversight of our independent auditors and the integrity of our financial statements. Our Audit CommitteeAC held sixfour meetings in 2022.2023.

Compensation and Human Capital Committee. Ms. Sharps Myers and Messrs. Alvarez and Sterling serve as members of our Compensation and Human Capital Committee,CHCC, and Ms. Sharps Myers serves as its chair. Our Compensation and Human Capital CommitteeCHCC is responsible for, among other things, establishing and administering our policies, programs, and procedures for compensating our executive officers and Board. The Compensation and Human Capital CommitteeCHCC may only delegate its authority to subcommittees of its members. None of the members of our Compensation and Human Capital CommitteeCHCC is an officer or employee of our Company. None of our executive officers currently serves, or in the past year has served, as a member of the Boardboard of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation and Human Capital Committee.CHCC. Our Compensation and Human Capital CommitteeCHCC held fivefour meetings in 2022.2023.

Nominating and Corporate Governance Committee. Messrs. Alvarez and Stern, and Ms. St.Clare serve as members of our NCG CommitteeNCGC, and Mr. Alvarez serves as its chair. Our NCG CommitteeNCGC is responsible for, among other things, evaluating new director candidates and incumbent directors and recommending directors to serve as members of our Board committees. Our NCG CommitteeNCGC held sevenfour meetings in 2022.2023.

Director Nominees

Our Board believes that the Board should be composed of individuals with varied, complementary backgrounds who have exhibited proven leadership capabilities within their chosen fields. Directors should have the ability to quickly grasp complex principles of business and finance, particularly those related to our industry. Directors should possess the highest personal and professional ethics, integrity, and values and should be committed to representing the long-term interests of our stockholders. When considering a candidate for director, the NCG CommitteeNCGC will take into account a number of factors, including, without limitation, the following: depth of understanding of our industry; education and professional background; judgment, skill, integrity, and reputation; existing commitments to other businesses as a director, executive, or owner; personal conflicts of interest, if any; diversity; and the size and composition of the existing Board. Although the Board does not have a policy with respect to consideration of diversity in identifying director nominees, among the many other factors considered by the NCG CommitteeNCGC are the benefits of diversity in boardBoard composition, including with respect to age, gender, race, and specialized background. When seeking candidates for director, the NCG CommitteeNCGC may solicit suggestions from incumbent directors, management, stockholders, and others. Additionally, the NCG CommitteeNCGC may use the services of third-party search firms to assist in the identification of appropriate candidates. During 2022,2023, no director search fees were approximately $88,000 relating to the searches that led to the appointments of Erin Sharp and Michael Stern.incurred. The NCG CommitteeNCGC will also evaluate the qualifications of all candidates properly nominated by stockholders, in the same manner and using the same criteria. A stockholder desiring to nominate a person for election to the Board must comply with the stock holding and advance notice procedures of our Amended and Restated Bylaws, as described in the proxy statement under the heading “Stockholder Proposals for 20242025 Annual Meeting.”

Director Compensation

We believe that the compensation we provide to our Board is both competitive and in line with that provided to boards of directors of similar companies in our industry. We planFrom time to time, the Board will conduct a market assessment of director compensation.

For fiscal year 2023, the previous Board Chair received prorated annual compensation inof $26,658 until his retirement on May 25, 2023.

For fiscal year 2022, the Chairman of our Board received annual compensation of £50,000 (approximately $60,450 using the pound sterling to U.S. Dollar spot exchange rate of 1.209 published in The Wall Street Journal as of December 31, 2022), payable in four quarterly installments. He also received an annual grant of restricted shares of our Common Stock valued at £20,000 (approximately $26,144 based on the fair market value on the date of grant), which vest in three tranches over two years.

For fiscal year 2022,2023, all non-employee directors received an annual cash retainer of $40,000, (prorated for time of service), payable in four quarterly installments. The Chair of the Audit CommitteeAC received an additional $25,000, the Chair of the Compensation and Human Capital CommitteeCHCC and the Chair of the NCG CommitteeNCGC each received an additional $15,000, and members of a board committee received an additional $5,000 (prorated for time of service).each committee on which they served. All additional cash payments are paid in four quarterly installments. All non-employee directors received an annual grant of options to purchase 2,500125 shares of our Common Stock (with an exercise price equal to the fair market value on the date of grant), with vesting daily over one year. In addition, Ms. Sharps Myers receivedthrough the date of the next annual meeting and a grant of options to purchase 1,486 shares$20,000 of our Common Stock for prorated service during 2021.restricted share units that vest at the date of the next annual meeting.

The following table discloses all compensation provided to the non-employee directors for the most recently completed fiscal year ended December 31, 2022:2023:

Director Summary Compensation Table

| | | | | | | | | | |

| | | | As of December 31, 2022 | | | | As of December 31, 2023 |

| Fees earned or | Stock | Option | | Unvested | Unexercised | Fees earned or | Stock | Option | | Unvested | Unexercised |

| paid in cash | Awards (3) | Total | Stock | Stock | paid in cash | Awards (2) | Total | Stock | Stock |

Name | ($) | ($) | ($) | Awards | Options | ($) | ($) | ($) | Awards | Options |

R. Clothier | $ 60,450 | $ 26,144 | $ - | $ 86,594 | 18,735 | - | $ 26,658 | $ - | $ - | $ 26,658 | - | - |

R. Alvarez | 55,968 | - | 2,813 | 58,781 | - | 4,583 | 67,500 | 20,000 | 900 | 88,400 | 2,778 | 355 |

T. Fisher (1) | 16,129 | - | 2,813 | 18,942 | - | - | |

A. Kirk (1) | 16,129 | - | 2,813 | 18,942 | - | - | |

E. Sharp (2) | 26,855 | - | 908 | 27,763 | - | 2,500 | |

E. Sharp | | 45,000 | 20,000 | 900 | 65,900 | 2,778 | 250 |

G. Sharps Myers | 60,000 | - | 4,202 | 64,202 | - | 3,986 | 60,000 | 20,000 | 900 | 80,900 | 2,778 | 325 |

C. St.Clare | 70,000 | - | 2,813 | 72,813 | - | 20,800 | 70,000 | 20,000 | 900 | 90,900 | 2,778 | 1,165 |

R. Sterling | 45,968 | - | 2,813 | 48,781 | - | 7,000 | 50,000 | 20,000 | 900 | 70,900 | 2,778 | 475 |

M. Stern (2) | 26,855 | - | 908 | 27,763 | - | 2,500 | |

J. Turk (1) | 16,129 | - | 2,813 | 18,942 | - | - | |

M. Stern | | 45,000 | 20,000 | 900 | 65,900 | 2,778 | 250 |

Total | 394,483 | 26,144 | 22,896 | 443,523 | 18,735 | 41,369 | 364,158 | 120,000 | 5,400 | 489,558 | 16,668 | 2,820 |

| (1) | | Mr. Fisher, Ms. Kirk and Mr. TurkClothier stepped down from the Board on May 27, 2022.25, 2023 and received a pro-rated fee for his time of service. |

| (2) | | Ms. Sharp and Mr. Stern were elected to the Board on May 27, 2022.

|

| (3)

| | The amounts in these columns represent the grant date fair value of stock awards and stock options granted in 2022,2023, calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 718. For a discussion of the assumptions used in calculating these values, see Note 8 to our consolidated financial statements in our annual report on Form 10-K for the fiscal year ended December 31, 2022,2023, filed with the SEC on March 7, 2023.April 1, 2024. |

The following table provides the aggregate outstanding equity awards held by each non-employee director as of December 31, 2022.

| | | | |

| | | Unvested | Unexercised |

| | | Stock | Stock |

Name | | | Awards | Options |

R. Clothier | | | 18,735 | - |

R. Alvarez | | | - | 4,583 |

E. Sharp | | | - | 2,500 |

G. Sharps Myers | | | - | 3,986 |

C. St.Clare | | | - | 20,800 |

R. Sterling | | | - | 7,000 |

M. Stern | | | - | 2,500 |

Total | | | 18,735 | 41,369 |

Vote Required